Loading...

Loading...

BlackRock, the financial giant that manages the USDC stablecoin funds

The world of cryptocurrencies has been undergoing a remarkable transformation in recent years. While initially perceived as an anomaly in the traditional financial system, cryptocurrencies are now gaining acceptance and legitimacy in the world of investment and finance. Behind this transformation is an unexpected but powerful player - BlackRock, the world's largest asset manager.

BlackRock's influence in the cryptocurrency market has begun to take shape through a strategic partnership with Circle, the issuer of the USD Coin (USDC), a stable cryptocurrency backed by real US dollars. This partnership has sparked a wave of speculation about the role BlackRock could play in the emerging digital economy.

USDC and its Global Economic Transformation.

USDC has become one of the prominent players in the rise of cryptocurrencies. This dollar-denominated digital currency presents itself as a safe haven amidst the volatility of the crypto market.

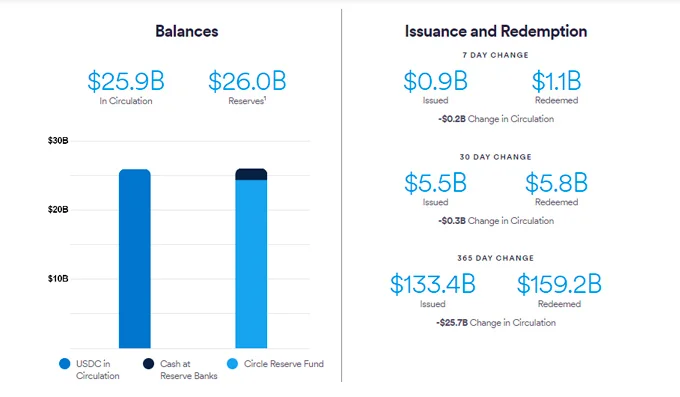

Each USDC unit is directly and individually backed by one US dollar in the most important US financial institutions. In other words, for every USDC in circulation, there is 1 US dollar deposited in US banks.

This solid backing has generated confidence among investors and users, driving mass adoption of USDC.

With more than USD $50 billion in circulation, USDC ranks second in the cryptocurrency market. Its growth and acceptance has not gone unnoticed by BlackRock, which has decided to get involved in this exciting financial space.

The Strategic Partnership with Circle

The key to BlackRock's entry into the world of cryptocurrencies is its strategic partnership with Circle. This partnership involves not only a financial investment, but also the exploration of USDC applications in the traditional capital markets. If successful, this partnership could mark the beginning of the adoption of stable cryptocurrencies in the mainstream financial system.

In addition, BlackRock will play a critical role as "the primary asset manager of USDC's cash reserves." This suggests that BlackRock is not only interested in cryptocurrencies, but also seeks a critical role in the management and custody of the assets backing USDC.

BlackRock's Rise in the World of Cryptocurrencies

BlackRock's move into the world of cryptocurrencies raises a number of intriguing questions. What does this mean for the future of investing and finance in an increasingly digital world? What will BlackRock's impact be on the adoption of stable cryptocurrencies in traditional markets?

What is clear is that BlackRock, with its impressive asset portfolio and global influence, is taking a significant step in the direction of the digital economy. As more investors and companies explore the possibilities of cryptocurrencies, BlackRock's involvement could be a catalyst for widespread adoption of digital assets backed by real assets.

Conclusion

The tie-up between BlackRock and Circle, along with its participation in USDC, marks an important milestone in the evolution of the cryptocurrency market. BlackRock is not just watching from the bleachers, but is taking a seat on center stage. Its influence and expertise in the financial world could be a key factor in the adoption and integration of cryptocurrencies into the global economic fabric. As these digital currencies continue their rise, BlackRock's involvement deserves close monitoring, as it could have a significant impact on the global economy and the way we handle money in the future.

NFT Trends

Your contribution is essential to keep our site online and support content creation.

We will verify the sending of the funds. This may take us a while.